5-Step Guide to Airbnb Investment – Strategies & Opportunities

But Airbnb real estate investing doesn’t always seem as simple as selecting a square on a board; you have to identify which property to buy and where, considering diverse markets that potentially span the globe.

Even as demand for Airbnbs continues to surge, getting into the short-term rental (STR) space can be daunting. There are so many markets that offer a significant return on investment for hosts and investors alike that it can be a challenge to pinpoint the top Airbnb investment location opportunities. But getting your investments right doesn’t have to feel like guesswork. With the right strategy and the right data, you have every chance of success.

What is an Airbnb investment property?

An Airbnb investment property is a property that you purchase with a view to renting it out to guests short-term through Airbnb rather than long-term through a real estate agency. Investing in short-term rentals works differently from conventional long-term rental properties and has unique benefits and risks.

How does Airbnb investment work?

To make money from vacation rental properties, real estate investors first identify areas that receive a lot of tourist and business traffic and then identify properties that would be suitable for renting out to these guests.

After ensuring that short-term rentals are permitted in that locality and HOA (if relevant), they typically obtain a home loan, furnish the property, arrange the necessary services, and list the property on Airbnb. From there, the investor can either host guests personally or hire an Airbnb host and a property management company to take care of day-to-day operations.

The primary return on investment comes from the profits from short-term rental income after deducting the mortgage, interest, and operating costs. The secondary (potential) return on investment comes from the appreciation in the property’s value over time.

Airbnb property vs conventional rental investment property

Having an Airbnb property is different than having a conventional investment rental property in several respects:

- Profits and risks. Airbnb rentals have higher earning potential and a higher level of risk compared to a conventional rental property. The higher earning potential comes from the fact that the average daily rate (ADR) is higher for short-term rentals than it is for long-term rentals. The risk is in the fact that your Airbnb property might only be booked half of the time (the exact percentage is referred to as your Airbnb occupancy rate). You’ll need to take occupancy rate into account when setting prices for your Airbnb.

- Upfront costs. Airbnb properties require a much higher upfront investment than conventional investment rental properties. You will not only cover the cost of things that tenants would usually pay for (like water, utilities, toiletries, and subscription services) and things that conventional investment homeowners pay for (mortgage and interest, land taxes, insurance, and HOA fees), but you’ll also need to furnish and decorate the property and pay for professional photography before you can list the property on Airbnb.

- Level of involvement. Airbnb properties require a lot more involvement than conventional rental properties. Guests will need to be checked in and checked out, there is a fair amount of back-and-forth communicating with current and prospective guests, and you’ll need to arrange for maintenance and repairs more frequently than you would with a conventional rental property.

Pros and cons of having an Airbnb investment property

Airbnb property investment itself has several advantages and disadvantages. These points can help you determine whether an Airbnb property could be a good fit for you and your goals.

Pros

- Passive income. You can potentially earn a passive income. This is especially true if you hire an Airbnb host and a property manager to take care of daily operations for you.

- Flexibility. You can stay at the property whenever you want. Because guests only come for a short time, you can easily block out dates for which you don’t want to make the property available.

- Potentially higher profits. If you have the right data to help you choose a lucrative destination and set your prices according to industry rates, you can make more money than you would with a conventional rental property.

- Assured payment. With short-term rentals, guests pay during their stay. In contrast, long-term tenants may be late in making payments.

- Guests pay for cleaning and damage. A cleaning fee is included in every booking and damages that guests don’t pay for can be reimbursed through AirCover. With a long-term rental, you have a security deposit but costs for damages in excess of that amount would require a complex and lengthy legal process to recover.

- No need for a real estate agent. Airbnb properties are listed on Airbnb, so you don’t need to pay an additional company to advertise your property and secure tenants for you. That said, you may want to vet guests yourself and will need to do so if you don’t have Instant Book turned on.

Cons

- Less income security. Conventional rental properties are almost guaranteed to have long-term tenants. In contrast, an Airbnb property may sit empty during much of your area’s low season.

- More active involvement. Airbnbs require a lot of involvement with setup, communication, checking guests in and out, attending to guests’ needs, booking cleaners, and so on. If you do the bulk of the work yourself, your Airbnb could become a part-time or even full-time job.

- Higher upfront costs. Airbnbs need to be furnished, decorated, and photographed before they can be offered for rent. In contrast, a conventional rental property simply needs to be insured and in good repair.

- Higher operating costs. Airbnb properties have higher monthly costs than conventional rental properties (toiletries, utilities, internet, TV subscriptions, furniture replacement, an on-site host, gardening services, and so on).

How to get started with Airbnb investment

You’ve considered the pros and cons and decided Airbnb investment is for you. Congratulations! A lucrative career may well lie ahead. Now, follow these five steps to start investing in Airbnb real estate.

1. Identify the best places to invest in Airbnbs

Investing in STRs isn’t the same as investing in other types of real estate. Identifying a great market to invest in an Airbnb is about two things: knowing how to research STRs and understanding STR regulations in your target markets.

Some markets are more STR-friendly than others, which is why you might ultimately invest in one market over another, even if all else is equal. But learning how to research for STR investments isn’t just about laws.

There are certain figures specific to STRs that can help you uncover whether or not an investment will be as profitable as you hope; statistics like capitalization rate can reflect both the level of risk of the investment and your potential return. Learning these figures can help you spot a great place to invest.

Get familiar with Airbnb rules and regulations

Some cities have friendlier STR regulations than others. For example, the local government in Maui, Hawaii, strictly limits the number of actively listed STRs on the island. This may sound like a detractor for investors, but it’s not that simple. Investors who can manage to secure a licensed STR in Maui find themselves in an enviable position—low supply, high demand, and limited competition.

Do your research into each market to understand not only what their regulations are, but also if they have any special zoning laws, taxes, or occupancy limits that might cut into your profitability.

Best Airbnb investment opportunities in 2022

Growth can be a great indicator of a worthwhile investment. In order to get a high-level understanding of markets with the most growth, tap into AirDNA’s latest Best Places to Invest report. It reveals the top Airbnb locations by country, along with revenue potential for STR investments.

See the Best Places to Invest around the world

2. Analyze Airbnb investments and real estate data in each market

Once you’ve decided on your investment’s location, it’s time to dive deeper into its neighborhoods, zip codes, and adjacent markets. Even after you’ve chosen a city, it’s important to analyze the factors within that city that can make your investment soar: competition, zoning laws, average daily rate (ADR), and more. Though you can find some of these figures manually, you can also use tools like MarketMinder™ to quickly generate the data you need.

In MarketMinder™, each market you analyze will reveal a Market Grade, average revenue and occupancy figures, quarterly growth, amenities, rate analysis, pacing, and more to spot the market that fits your Airbnb investment portfolio, niche, and goals.

You can use the following tabs within MarketMinder™ to determine which zip code or neighborhood may align with your goals. Be sure to take the time to explore each area and to fully understand your market.

Seasonality

Virtually all markets have high and low seasons. This is especially true for destination markets like lakeside retreats, ski towns, and beach towns. Take a look at monthly and daily RevPAR to see when you can expect revenue growth, historical travel trends, and booking windows each month of the year. Remember: If you’re in a highly seasonal market, you’ll want to factor that into the pricing strategy for your Airbnb real estate.

Supply and demand

Pacing tools in MarketMinder™ show you future demand for up to six months so you can get a sense of booking windows, booked rates, year-over-year comparisons, and occupancy rates in your markets. MarketMinder™ enables you to compare your markets with average historical rates and market projections to get a sense of Airbnb income potential.

Short-term rental research

While some markets are flooded with vacation rentals, others are hidden gems with high occupancy rates. You can compare the number of active listings with quarterly rental growth, annual revenue trends, occupancy rates per city, and types of amenities to know which property types will fit your portfolio and local competition.

3. Compare Airbnb investment opportunities in multiple markets

Comparing markets is the best way to find a city and a property that is likely to meet your investment goals. The simplest way to do this is with the Market Comparison tool within MarketMinder™.

Market Comparison reveals trending revenue and occupancy numbers for each market you explore. If you haven’t settled on a city or zip code to invest in, you can enter up to four locations at a time to compare Airbnb revenue, occupancy, and rate growth. But even after you’ve picked a city, you can use Market Comparison to drill down on top-performing zip codes and property sizes to maximize revenue and make a profitable investment.

Be sure to toggle between zip codes and neighborhoods, studio to 6-plus bedroom counts, and the number of guests the property can accommodate. Don’t forget to compare trend lines for revenue, occupancy, and year-over-year ADR to choose the most profitable combination.

4. Estimate your Airbnb investment income

Once you’ve decided on your market and property size, you’re ready to research rentals for sale. Zillow is a great place to start looking for listings that fit your criteria and can help you reach your Airbnb real estate investing goals. Once you filter for budget and property attributes, gather a few addresses of interest and head back to MarketMinder™. Rentalizer, the Airbnb Calculator, will instantly calculate your Airbnb income potential, as well as other essential markers to help make your decision.

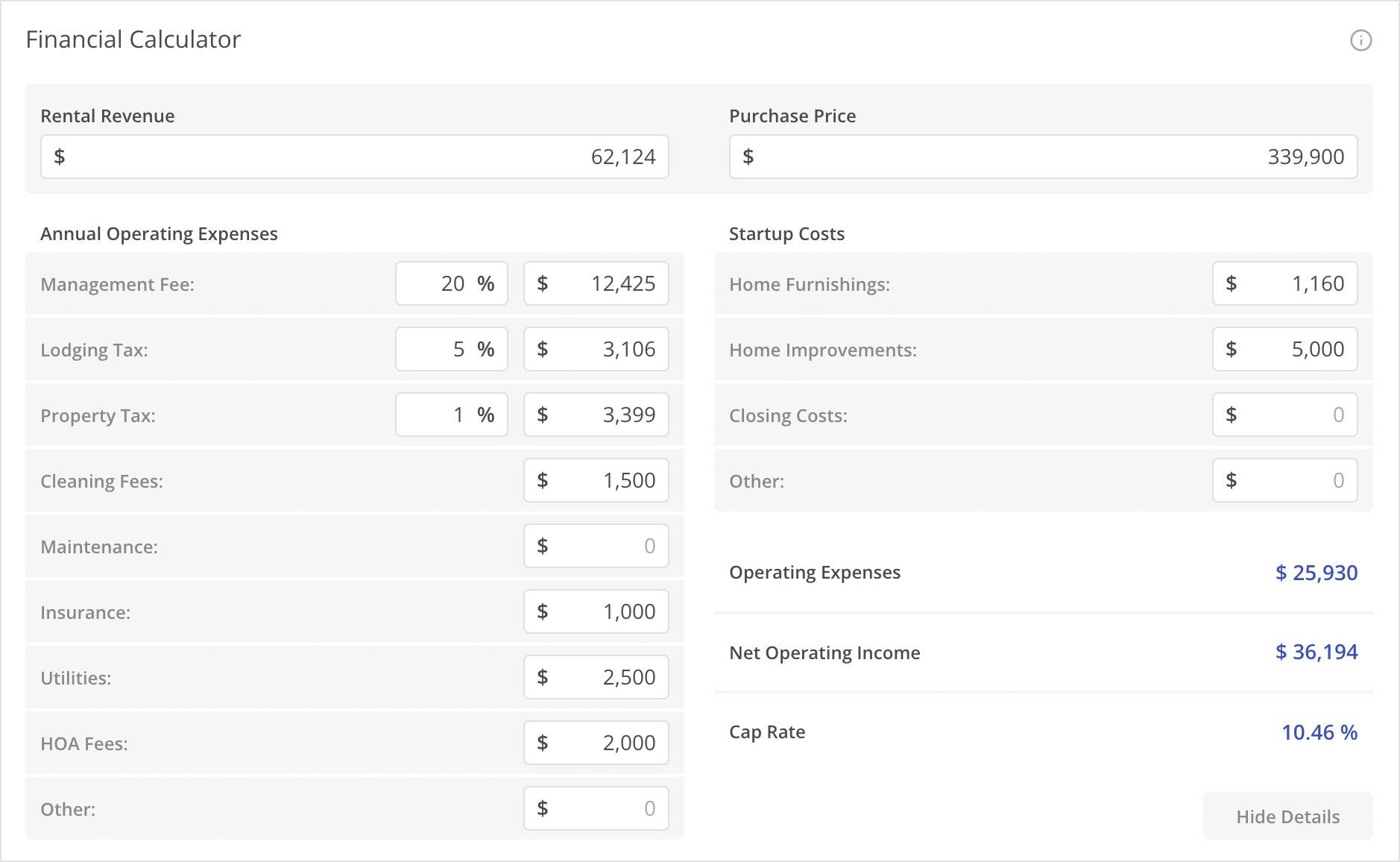

Enter any address and immediately receive annual revenue and occupancy projections. Take it one step further by entering the cost of the home and your projected major expenses into our financial calculator to receive operating income and cap rate to complete your investment research. With Rentalizer, estimating rent for your STR couldn’t be easier.

Rentalizer is great for those curious if Airbnb is profitable, investors identifying profit margins for their portfolios, individuals seeking new ways to earn passive income, vacation rental managers seeking to expand their management, and so much more.

Since 2022, Rentalizer now shows the two-year historical trend and seasonal forecasting in our estimates. Our confidence intervals will provide high and low estimates for each month of future revenue potential. Tracking the history of your vacation rental’s annual revenue estimate will address whether or not your rental market is appreciating in value.

5. Strategically price your Airbnb

The right pricing can have a huge impact on the profitability of your Airbnb investment. It’s important to remember that there is no single rate that’s right for your property; the daily rate you offer may change based on the day of the week, the season, and the supply/demand in your market. A successful pricing strategy should adapt along with these factors.

If you’re unsure about the right rate for your rental, MarketMinder™ has the answer. Once you purchase your property and list it on Airbnb, you can connect your listing to MarketMinder™ to access customized comp sets and receive your free Booking Performance Score for each listing.

You’ll receive:

- Booking Performance Scores for each connected property

- Competitor insights and performance metrics

- Personalized property-level dynamic pricing

- Comp set pacing

- Market-level insights

- And much more

The data in Custom Comps will keep your prices optimized, support occupancy to hit your business goals, and deliver competitor insights handy to maximize your revenue potential—all in a single, easy-to-navigate dynamic Airbnb pricing platform.

Pricing

One benefit to using Custom Comps is comparing Smart Rates, our Airbnb dynamic pricing tool, against your personalized comp sets. This allows you to visualize pricing trends to see if your comps are being booked more often or at higher rates than yours; you can also tap into the accompanying recommended rates calendar to help adjust your rates 12 months out.

*Pro tip: You can change the price settings to focus on occupancy rates versus aggressive revenue goals.

Pacing

Not only can you see your comp rates in our pricing feature, but also keep tabs on when they’re being booked, how far out, and their rate projections. You’ll be able to spot travel spikes in advance and outsmart your competition for each property you’ve connected to MarketMinder™. Filter your comps based on amenities, distance, ratings, reviews, and more, and select a truly personalized comp set.

FAQ

Is Airbnb a good investment?

Investing in Airbnbs can be a great way to expand your income opportunities. Though there is risk involved in Airbnb real estate investments, there are also sizable returns; many investors see a return of 40% or more, which is far higher than the average percentage yield on a U.S. savings account of just 0.07%.

Doing your research, making strategic investments, and continually optimizing your listing with the right data can help increase the return on your investments.

Is Airbnb profitable?

Whether or not your Airbnb is profitable depends on several factors. Though many investors do see a solid return on their Airbnb real estate, there is no silver bullet to making a profit by hosting Airbnbs. The property type and size, location, guest demand, ADR, occupancy rates, and more can all impact how profitable an Airbnb turns out to be.

Of all the factors that can impact your profitability, location may be at the top of the list. Destination properties may see a greater return than those in metropolitan areas, but they also have to contend with high and low seasons, something metropolitan areas are often immune to. Choosing a market that can sustain your income goals is the first step in paving the way toward profitability.

Excel at Airbnb real estate investing with a data tool

Here’s the truth: Finding the perfect property and then pricing it competitively can be challenging, and even tedious, without the right tools. But it doesn’t have to be, whether you’re a first-time investor or simply looking to add to your portfolio. The data tool MarketMinder™ makes Airbnb real estate investing easy.

With MarketMinder™, you’ll have at your fingertips the tools, data, and confidence you need to operate a successful STR business. But don’t just take our word for it. Jump into MarketMinder™ today and see how easy it is to hit the ground running and watch your Airbnb investment revenue grow.